Introduction

Lubricant manufacturers worldwide are facing a multitude of challenges. Mature markets, volatile raw material prices, tariff changes, difficulty of inventory management, suboptimal productivity, poor utilisation rates of equipment, high downtime and associated production capacity loss, energy inefficiency, high maintenance spend and turnover of critical employees are amongst the growing obstacles for global majors as well as independent players. There is an increased emphasis on understanding the drivers of performance that show the largest gap to best practice.

Some companies have a policy to aim for “best quartile” performance. However, this immediately raises difficulties:

- What should be the appropriate measure of success? Should operating expenditure be the sole barometer of success, or should losses, labour productivity, asset efficiency and safety performance be considered?

- What comparison sets to use? Should this be a country, a region or a global comparison? Should this be versus global majors, independent players or both?

- Since labour represents the biggest portion of operating expenditure, and pay rates are location dependent, should pay rates be normalised, since a plant cannot change its location?

- Since complexity is the biggest driver of operating expenditure after labour, and generally intrinsic to a plant’s mission, how to correct for differences in that?

- Since scale of operation is also a key cost driver, should the performance evaluation correct for that?

- What about other“givens”such as proximity to suppliers, order sizes, lead times, access to secondary warehouses, etc.?

Over the last 30 years, PIMS has provided lubricants and greases manufacturers with concrete recommendations to improve their competitive position based on objective evidence. Based on our research and experience, some plants consistently and substantially outperform their regional peers. These regional champion plants have a significant cost advantage versus peers, operate substantially below their expected1 cost thresholds and attain a superior productivity position.

In this paper, we will explore the profile and key attributesof the champion plants that enable them to have the upper hand versus competition.

Overview: EMEA

In the 2016-2017 cycle of the PIMS® Lubricants and Greases Benchmarking, the average volume of finished lubricants produced by a plant in the EMEA region was 45,000 tons. The median volume in Europe has remained stable at around 47,000 tons per annum, while the Middle-East & Africa (MEA) median has increased by % from 2010-2011 to 42,000 tons in 2016-2017. The aggregated complexity index2 of 54% for the region is 4 percentage points above the global average. Whilst the median complexity for Europe sits around 56%, a median complexity of 48% for MEA brings down the aggregated average.

Profile: Champions versus regional peers

The average annual throughput of the champion lubricants manufacturers in EMEA is 120,000 tons, whilst other plants in the region (the “peers”) have a significant scale disadvantage with an average throughput of 45,000 tons.

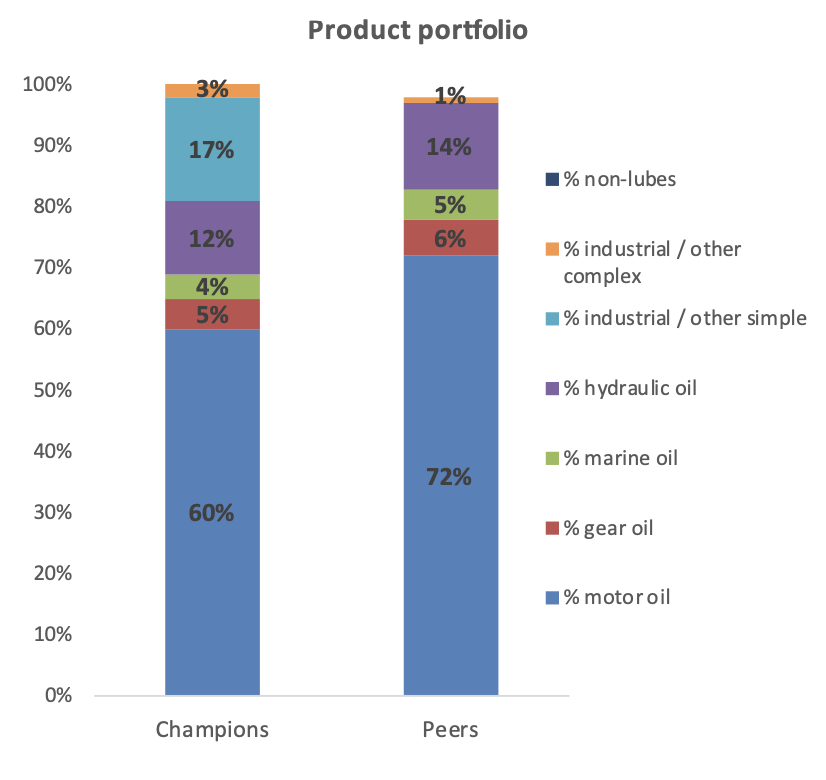

In Figure 1 we see that the product portfolio of the champions aligns with that of the peers, with motor and hydraulic oil accounting for almost 90% of the portfolio. For the champions, 65% of the volume is produced using an inline blender and the remaining via automatic batch blending. In contrast, although 83% of the peers’ throughput is produced via in-line blending, the remaining 17% is carried out by manual batch blending.

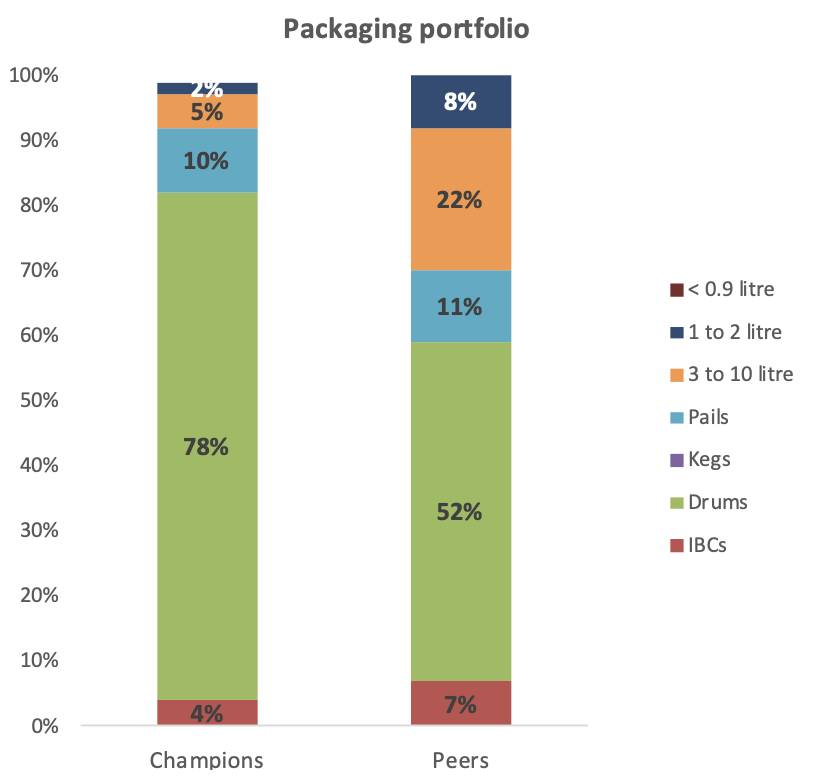

Despite being more than 2.5 times larger in volume blended, the average volume packed in-house by the champion plants of 57,000 is only 30% more than the regional peers at 44,000 annually. This higher proportion of bulk is one aspect that enables the champions to have a less complex operation. Figure 2 below shows the packing distribution of the champions and the peers. The champions are filling almost 80% of their volume into drums in comparison to 52% for the EMEA peers. Notably, peers fill 30% of the volume into less than 10 litre packs, and this increases the complexity of operation.

Figure 2 showing the packing portfolio of the champions and peers in EMEA

So what enables these champion plants to have a competitive advantage versus peers in the region?

Productivity and batch sizes: Champions versus the rest

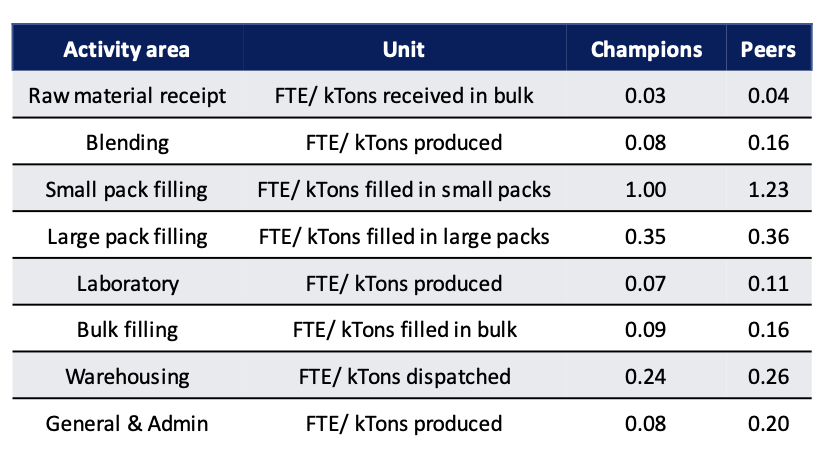

Table 1 below shows the productivity of the champion plants versus the peers in EMEA across all core activity areas of the plant. The champion plants in EMEA have a better productivity position across the board. In labour intensive departments such as small pack filling, the champions require a factor of 23% fewer full time equivalents in comparison to the peer, even though their focus (volume wise) is on large pack filling. In addition, the in plant General & Administrative operations is significantly more streamlined. In EMEA, 58% of the plant OPEX arises from personnel related costs such as salaries, benefits, social costs, etc. Thus, this streamlined effort enables the champions to gain a competitive advantage versus the peers. What is it about the processes of the champions that promote productivity?

Table 1 showing the labour productivity of the Champions and peers across core activity areas of a lubricant manufacturing facility

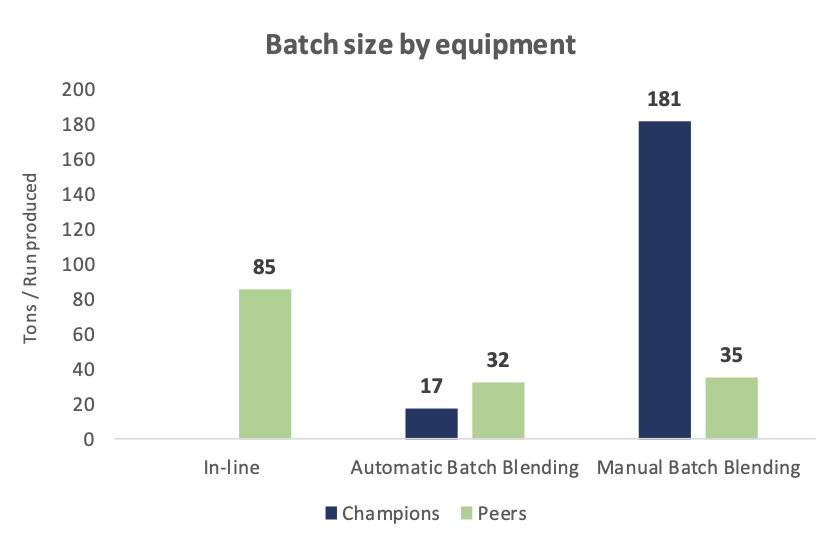

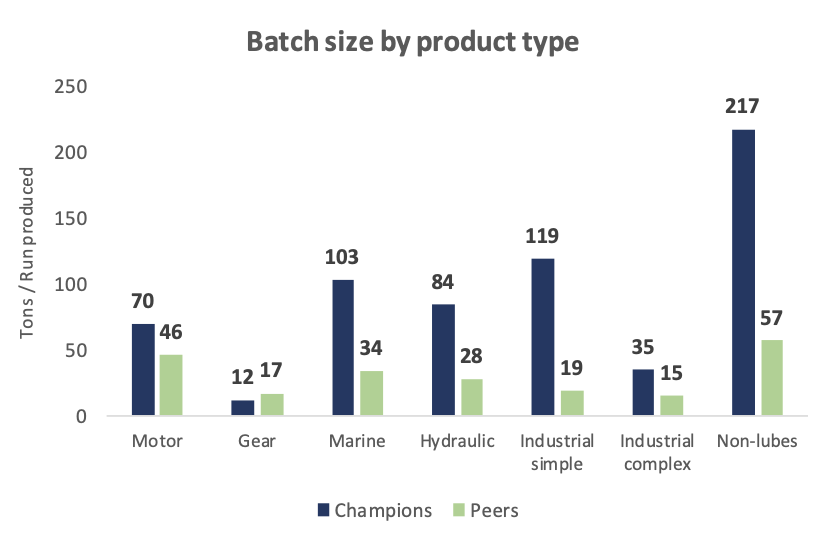

In Figure 3 below, we see that the blend batch size (on an equipment basis) of the champions is almost 6 times bigger in comparison to the regional peers. Although the champions have some automatic batch blending, majority of the production is undertaken via manual batch blending. Notably, despite manual batch blending, champions’ batch size is more than double that of the peers’ in-line blending. The average blending time per batch for the champions of 6.30 hours is 20% higher than that of the peers. However, this is excellent given the difference in batch sizes. When the batch sizes are evaluated on a product basis (see Figure 4), the champions’ have a substantial advantage across all product type aside from gear oil. The economies of scale in conjunction with faster utilisation rates boost productivity in the production department.

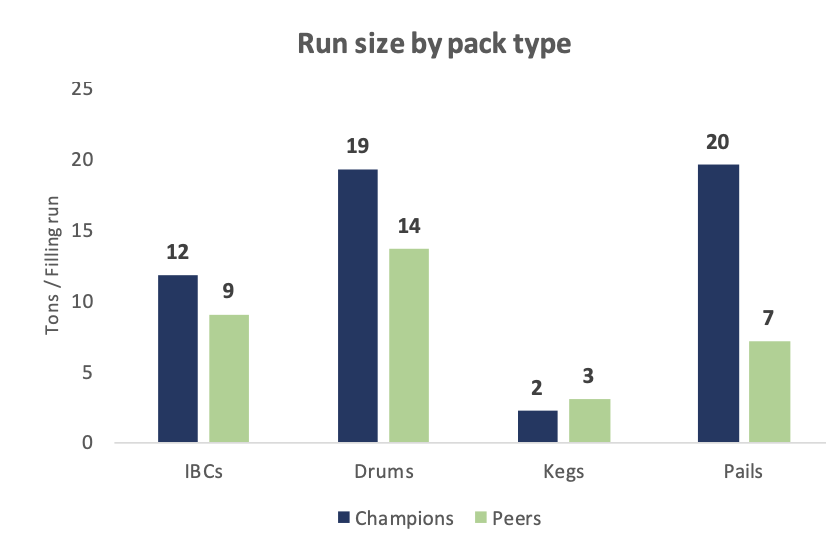

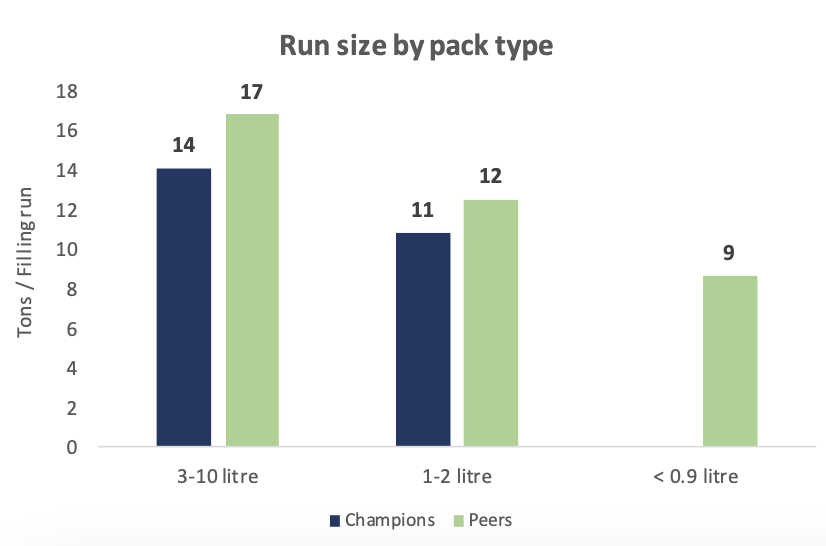

In the large pack filling department (see Figure 5), champion plants have a 5.6 and 12.5 ton per filling run advantage for Drums and Pails respectively. In contrast, the champions’ small pack batches are smaller in comparison to their regional peers.

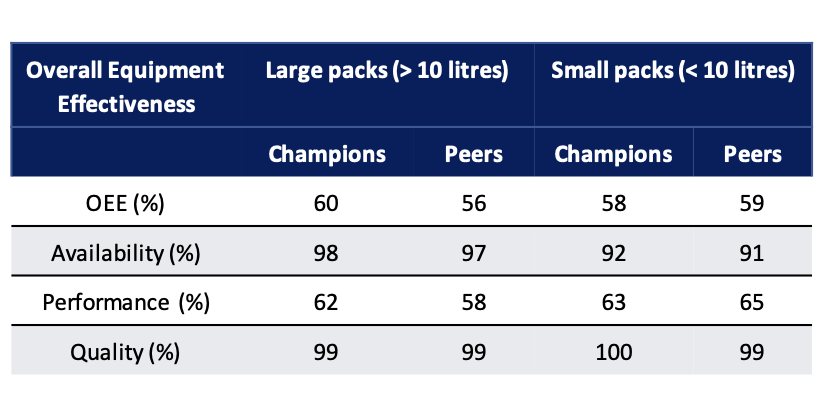

Table 2 above shows the aggregated OEE3 and component scores for the large pack and small pack filling lines for the champions and the regional peers. The champion plants manage their filling operation with fewer unplanned stoppages and are better at managing the planned downtime and thus outperform their peers on Availability. The utilisation rates of the champions (as indicated by the Performance aspect) for the large packs lines are significantly higher than the peers, although there is significant spare capacity for the < 10 litre lines. Thus, bigger batches, higher utilisation rates (for large pack lines) and well managed downtime boosts productivity in the packaging department. The quality component of OEE is very well managed in Americas. The OEE results indicate that significant investment in newer equipment is beneficial providing the labour productivity improves significantly.

Table 2 above the aggregated OEE3 and component scores for the large pack and small pack filling lines for the champions and the regional peers. The champion plants outperform the peers on Availability, and thus have fewer unplanned stoppages and are better at managing the planned downtime. The utilisation rates of the champions (as indicated by the Performance aspect) for the large packs lines is higher than the peers, although there is a room for improvement for the < 10litre lines. Thus, bigger batches, faster utilisation rates (for large pack lines) and well managed downtime boosts productivity in the packaging department.

Summary

The champion plants in EMEA are exploiting economies of scale by producing and filling the finished lubricants in bigger batches in comparison to their regional peers. This, in conjunction with better utilisation rates, low complexity and well managed downtime boost productivity. Ultimately, this streamlined effort enables the champions to have a significant competitive advantage versus regional peers. Champions get to the top by being better managed and more aligned with the rest of the supply chain – not by having more or newer equipment. There is a significant time delay between the installation of new equipment and the reaping of the benefits – which in turn also depends on how well managed the plant is. Champion plants typically invest modestly and focus on few but important goals. This is not the result of magic or coincidence but hard work and professionalism.

1 Mathematical model that quantifies the expected operating cost of a manufacturing plant, given its strategic profile.

2 The PIMS® complexity index quantifies the difficulty of the job the plant is undertaking and is driven by variety. The higher the variety handled by the plants (i.e. formulations, SKUs, components, etc.) the more complex the operations. The least complex plant worldwide has a complexity index of 0% whilst the most complex one has a complexity index of 100%.

3 Availability takes into account all events that stop planned production long enough where it makes sense to track a reason for being down. Performance takes into account anything that causes the manufacturing process to run at less than the maximum possible speed when it is running. Quality takes into account filled packages that do not meet quality standards.